5.5.7.c. How to Check Inventory and Product Costs?

In order to display inventory and product costs, go to Navigation > Warehouses > in here click on Display Cost button.

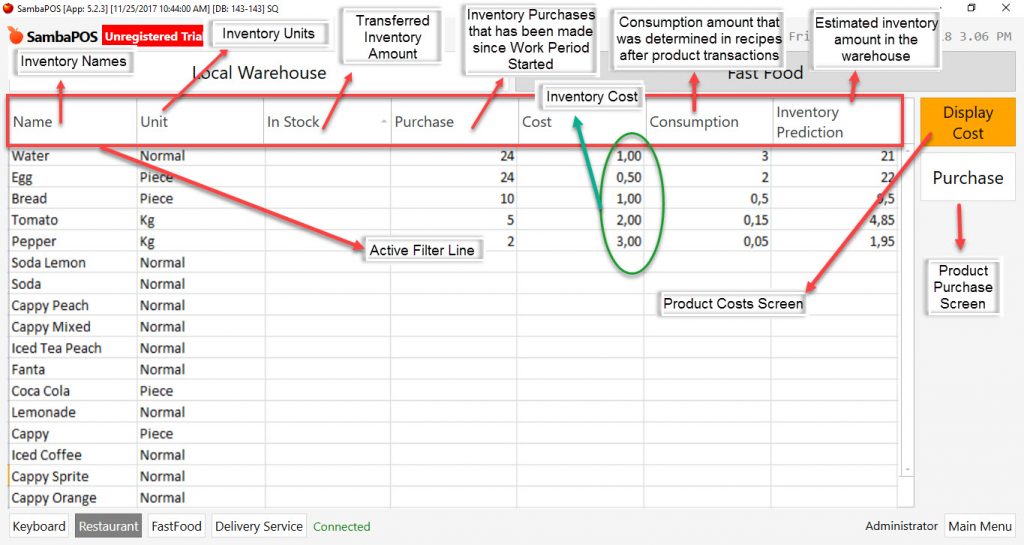

Note: In the warehouses, it is possible to display only cost status of products and inventories after Start Work Period process. If desired to display cost of different working periods, go to Navigation > Reports > Cost Report.

1- Inventory Cost: Calculated by dividing inventory purchase price total to inventory quantity total.

2- Product Cost: Calculated by dividing inventory quantity which was used in recipes to inventory cost.

Inventory: Includes purchased products, semi-finished products, and raw materials. Proportion of current products to purchasing prices, determines the inventory cost.(For examaple; tomato, pepper, oil, bread, water)

Product: Ready for sale goods which were produced by using standard amounts of inventories. Proportion of used inventory amounts to purchasing prices, product cost.

Cost column on the warehouses screen is the inventory cost.

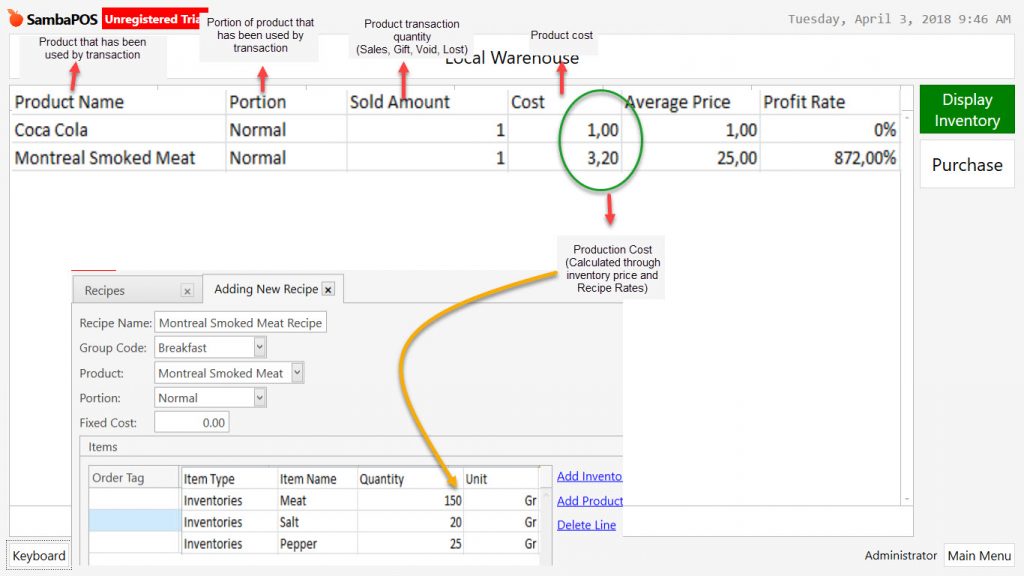

3- Product Cost: The columns that viewed when clicked on Display Cost button are;

- Product Name: Products that are sold. (Must have production recipe)

- Portion: Portions of the sold products. (Must have production recipe)

- Sale Amount (Quantity): Sold product quantity.

- Cost: Product cost (Proportioning of inventory cost to quantity, must have recipe.)

- Average Price: Average sales price of products.

- Profit Rate: Calculated by proportioning of inventory cost to product sales price average.

Hint;

Inventory amount makes changes for the sales, gift, void and lost transactions.

Profit rates makes changes for the sales, gift, void and lost transactions.

Inventory cost makes changes for inventory purchases.

Inventory cost doesn’t make change for sales, gift, void and lost transactions.

The cost that viewed on display cost screen is the product cost.