5.4.8.b. How to Use Cash Register?

You can display Cash Register from Accounts menu on the SambaPOS navigation screen. It is used for recording expenses and incomes that has been made through cash incomes account.

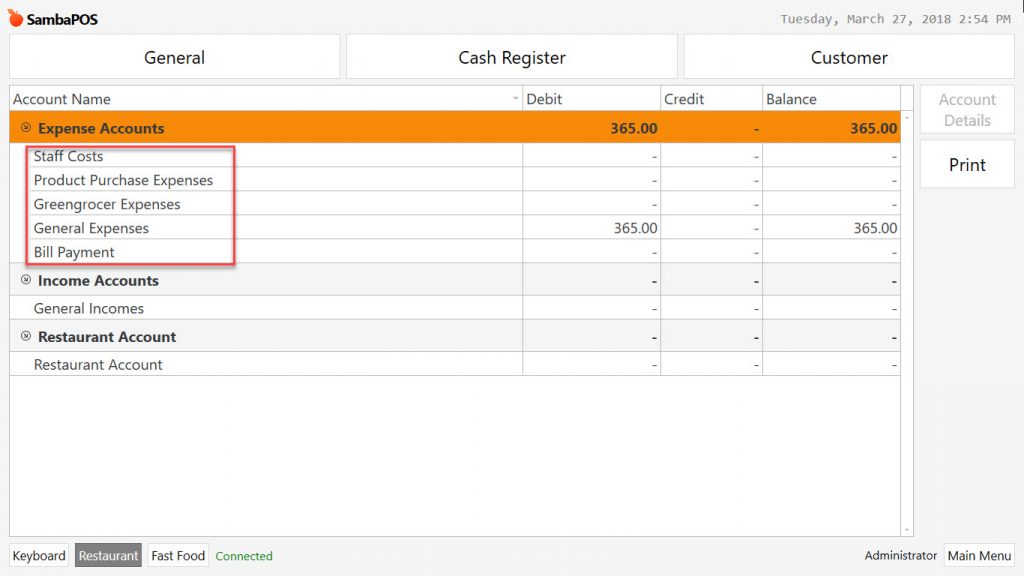

1- Expense Accounts

- General Expenses

- Shopping Expenses

- Bill Payment

- Supplier Payment

- Restaurant Expenses

For cash expenses, under the Expense Accounts tab, click on one of the titles which was created previously, according to need.

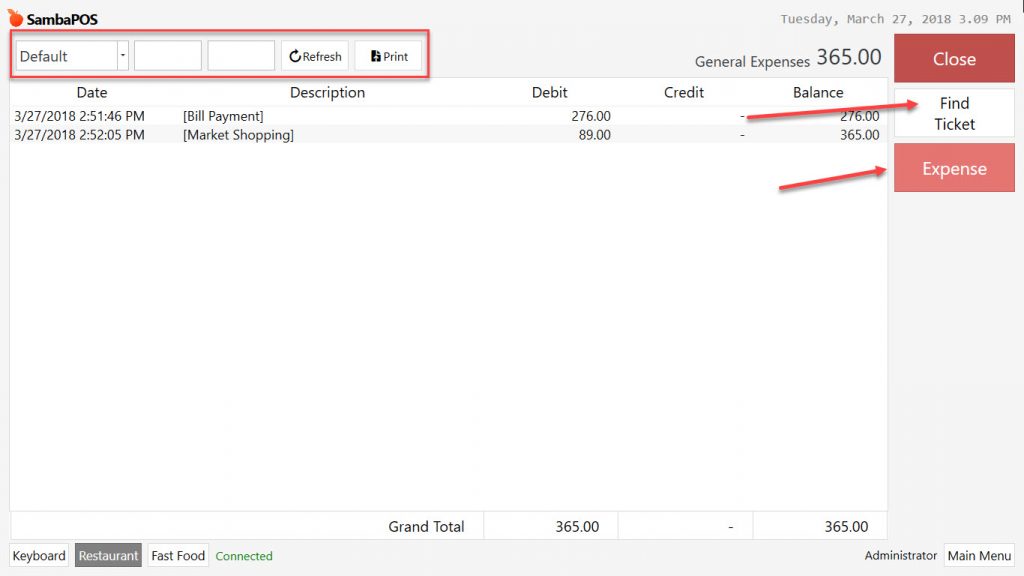

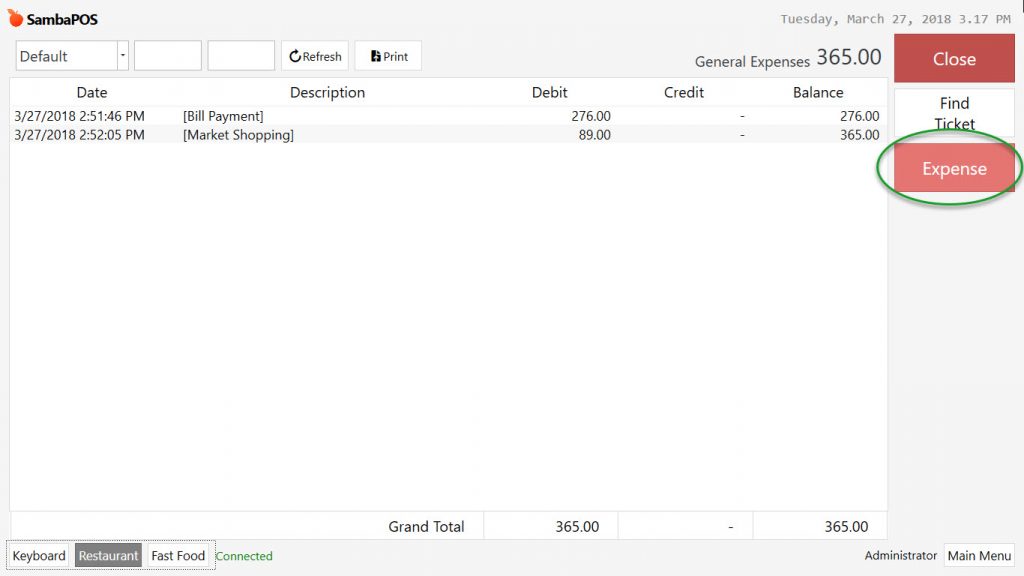

In order to view transaction of account to spend, select account and click on Account Details button. You can use date and period filters, also it is possible to print account statements from here.

In the transaction lines, date, time, description is displayed. Grand total is shown at the bottom right side in the balance column.

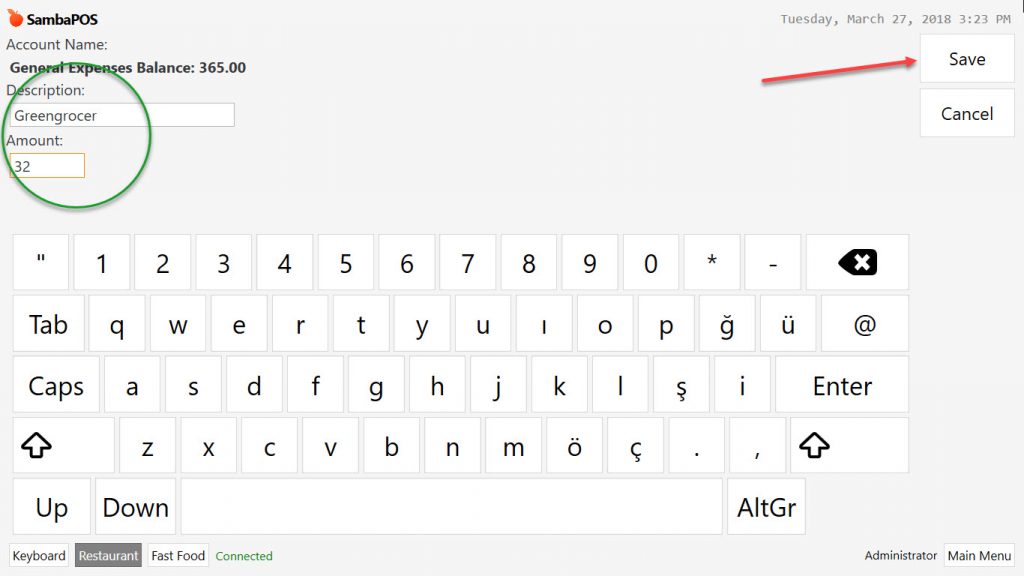

When you click on Expense button, a window will be opened for expense transaction.

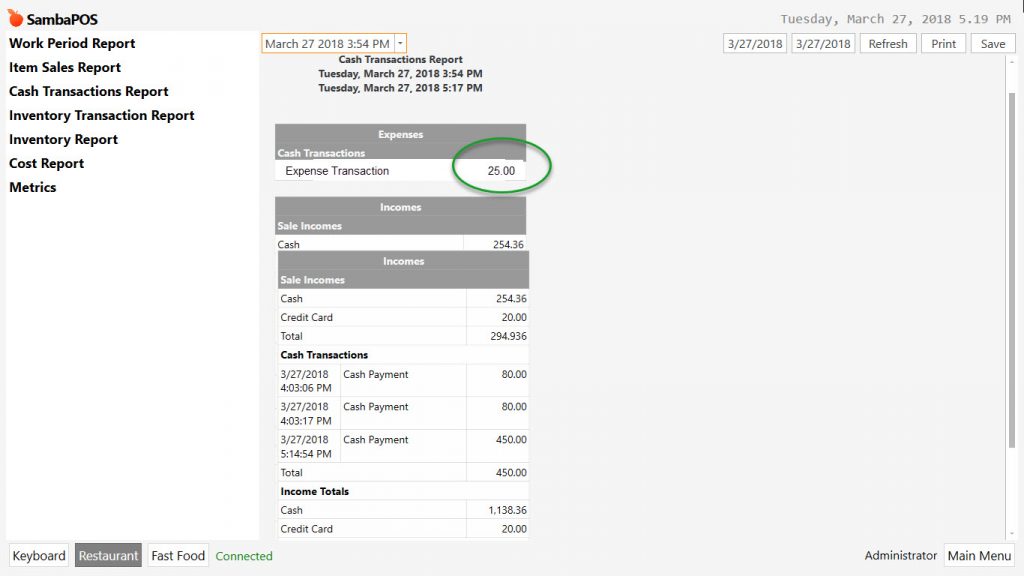

It is possible to write note about expense transaction. This note can be displayed on details of account transactions and on the reports. If nothing is written then it saves by using default description automatically.

Write spending amount into amount field and click on save button.

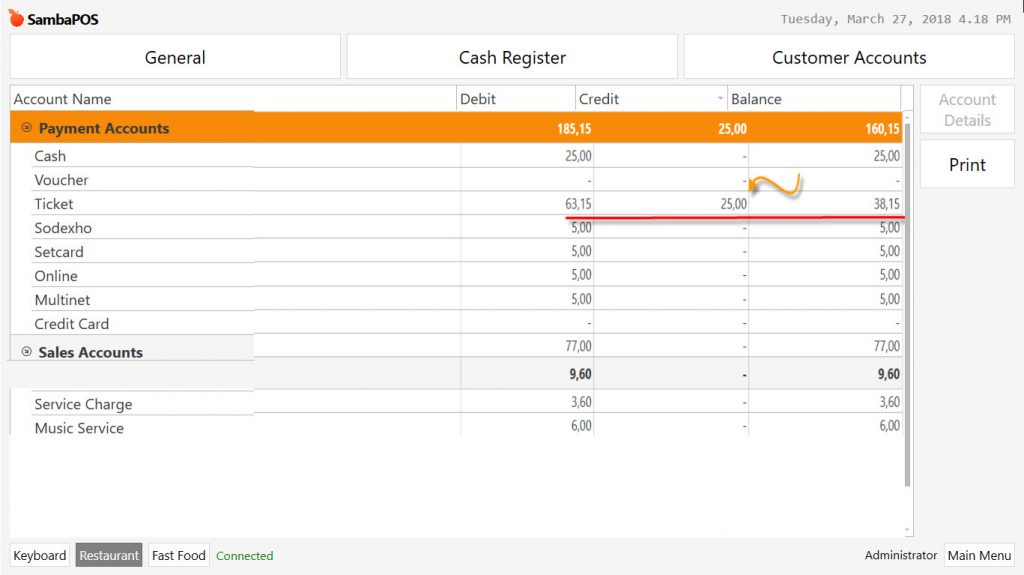

Grand total of expenses will be deducted from cash accounts under the general accounts title.

Notes:

1- If expense amount is more than cash amount of payment accounts, account amount becomes negative balanced. When there is income for payment accounts, this amount is deducted from negative balance.

2- After saving an expense transaction incorrectly, it can’t be deleted, changed or edited. Faulty amount is saved as income transaction, so that situation becomes documented. If desired, it can be added an explanation about the situation into the description field.

2- Income Accounts

Out of Sales General Incomes:

It includes the cash income actions that out of sales. Out of sales incomes are added to cash accounts in the general incomes.

Out of sales account transactions are displayed in the cash register report.