5.1.10.a. SambaPOS Accounting System

Credit and debit accounts are technically the same thing in SambaPOS. If you want a credit account, you make sure it always has a negative balance. If you want a debit account, you make sure it always has a positive balance. So, accounts with a balance between brackets are credit accounts and the other accounts are debit accounts.

To understand the SambaPOS accounting system better, you have to realize when you see negative numbers (balance between brackets), that doesn’t mean the amount is negative. It means it’s a credit account. There’s a difference between the amount shown and its ‘absolute value’, which is the actual amount no matter if it’s positive or negative. That the Sales account balance is between brackets does not mean you have negative sales, it means it’s a credit account like in classical accounting.

Debit accounts

(positive balance)

Some common Debit Account types:

-

Cash Drawer

-

Bank Accounts

-

Paid Expenses

-

Discounts (inverse revenue)

-

Receivables

To increase the ‘absolute value’ (balance without a plus/minus) of a debit account (make it more positive), you need an account transaction that:

-

Increases the balance (adds to the ‘debit’ part) of the account

-

Decreases the balance (adds to the ‘credit’ part) of another account

To decrease the ‘absolute value’ (balance without a plus/minus) of a debit account (make it more negative), you need an account transaction that:

-

Decreases the balance (adds to the ‘credit’ part) of the account

-

Increases the balance (adds to the ‘debit’ part) of another account

Credit accounts

(they have a negative balance)

Some common Credit Account types:

-

Sales/income

-

Tips

-

Tax

-

Prepaid Sales/customer credit accounts (customer accounts, SambaCards, etc)

To increase the ‘absolute value’ (balance without a plus/minus) of a credit account (make it more negative), you need an account transaction that:

-

Decreases the balance (adds to the ‘credit’ part) of the account

-

Increases the balance (adds to the ‘debit’ part) of another account

To decrease the ‘absolute value’ (balance without a plus/minus) of a credit account (make it more positive), you need an account transaction that:

-

Increases the balance (adds to the ‘debit’ part) of the account

-

Decreases the balance (adds to the ‘credit’ part) of another account

Account Statements (Account Transactions)

Taking money out of an account or adding to it, you can do with an Account Transaction. Account transactions take an amount of money away from the source account and add it to the target account. They do that by putting the amount in the ‘credit’ field of the source field and also in the ‘debit’ field of the target account.

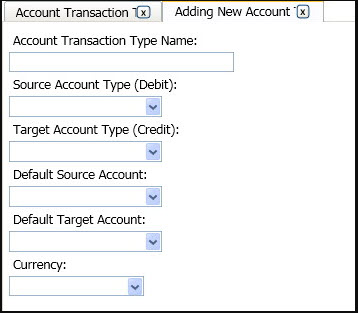

Account Transaction Fields and Usage

Default source account:

This is the account where money is subtracted from by the transaction (by adding to its ‘credit’ part), decreasing the account balance (but not necessarily the ‘absolute balance’).

For a debit account, the ‘absolute value’ will go down. (In classical accounting this is called ‘crediting a debit account’) For a credit account, the ‘absolute value’ will go up. (In classical accounting this is called ‘debiting a credit account’)

Default target account:

This is the account where money is added to by the transaction (by adding to its ‘debit’ part), increasing the account balance (but not necessarily the ‘absolute balance’).

For a debit account, the ‘absolute value’ will go up. (In classical accounting this is called ‘debiting a debit account’) For a credit account, the ‘absolute value’ will go down. (In classical accounting this is called ‘crediting a credit account’)

If you do not set up a default target account in transaction types any buttons you define with a document typewill not be available.

Increasing/decreasing the ‘absolute value’ of an account

to increase the ‘absolute value’ of a credit account (Sales, SambaCard, etc): you select the account in the ‘source account’ field of an Account Transaction

to decrease the ‘absolute value’ of a credit account (Sales, SambaCard, etc): you select the account in the ‘target account’ field of an Account Transaction

to increase the ‘absolute value’ of a debit account (Cash, Receivables, etc): you select the account in the ‘target account’ field of an Account Transaction

to decrease the ‘absolute value’ of a debit account (Cash, Receivables, etc): you select the account in the ‘source account’ field of an Account Transaction

Usage

You first look at the account where you want to increase or decrease it’s ‘absolute value’ (for example ‘Sales’ must go up when you make a sale). You check if it’s a debit or credit account (Sales is a credit account, it has a negative balance). To increase the ‘absolute value’ of a credit account, it has to be put in the Default Source Account field (you’re taking an amount away from it’s balance). Then you have to find another account to put in the Default Target Account. The balance of this account will be increased (not necessarily the ‘absolute balance’ though). So you can choose either a debit account (of which the ‘absolute balance’ will go up) or another credit account (of which the ‘absolute balance’ will go down). In the case of Sales, it’s Cash (which is a debit account, so the ‘absolute balance’ will go up there..